a) Outcome of FY 2022/23 Annual Borrowing Plan (ABP)

In FY 2022/23, the National Treasury planned to borrow Ksh. 862.92 billion to finance the budget deficit, of which net external borrowing was Ksh. 280.73 billion and net domestic borrowing totalled Ksh. 582.19 billion. At end June 2023, the National Treasury had raised Ksh. 740.33 billion, comprising of net external borrowing of Ksh. 301.06 billion (107.2% of the target); and net domestic borrowing of Ksh. 439.27 billion (75.5% of the target). The shortfalls in borrowing in FY 2022/23 was attributed to tight liquidity conditions in the domestic and international capital markets. Due to shortfalls in realizing the borrowing targets in the FY 2022/23, the National Treasury lowered the net domestic borrowing to the level that can be achieved, while ensuring the yield curve remain upward sloping; and increased mobilization of concessional external financing from alternative sources including development financial institutions.

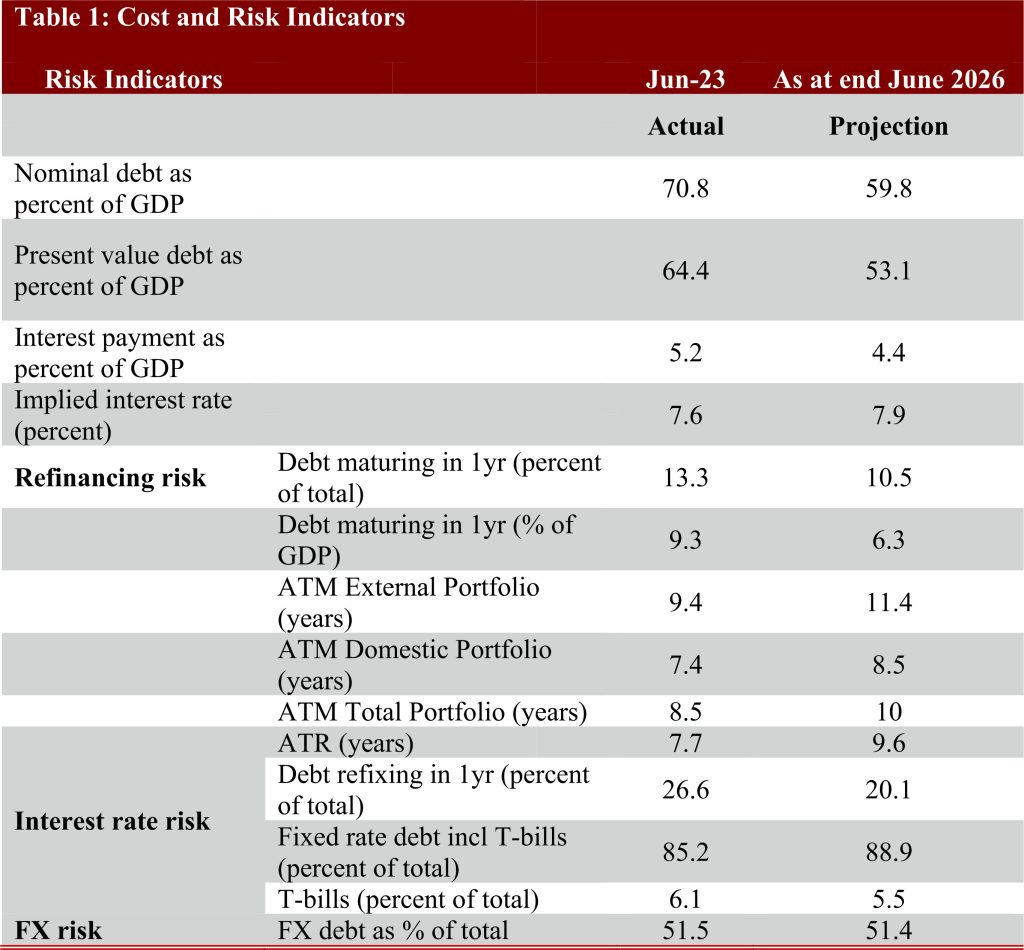

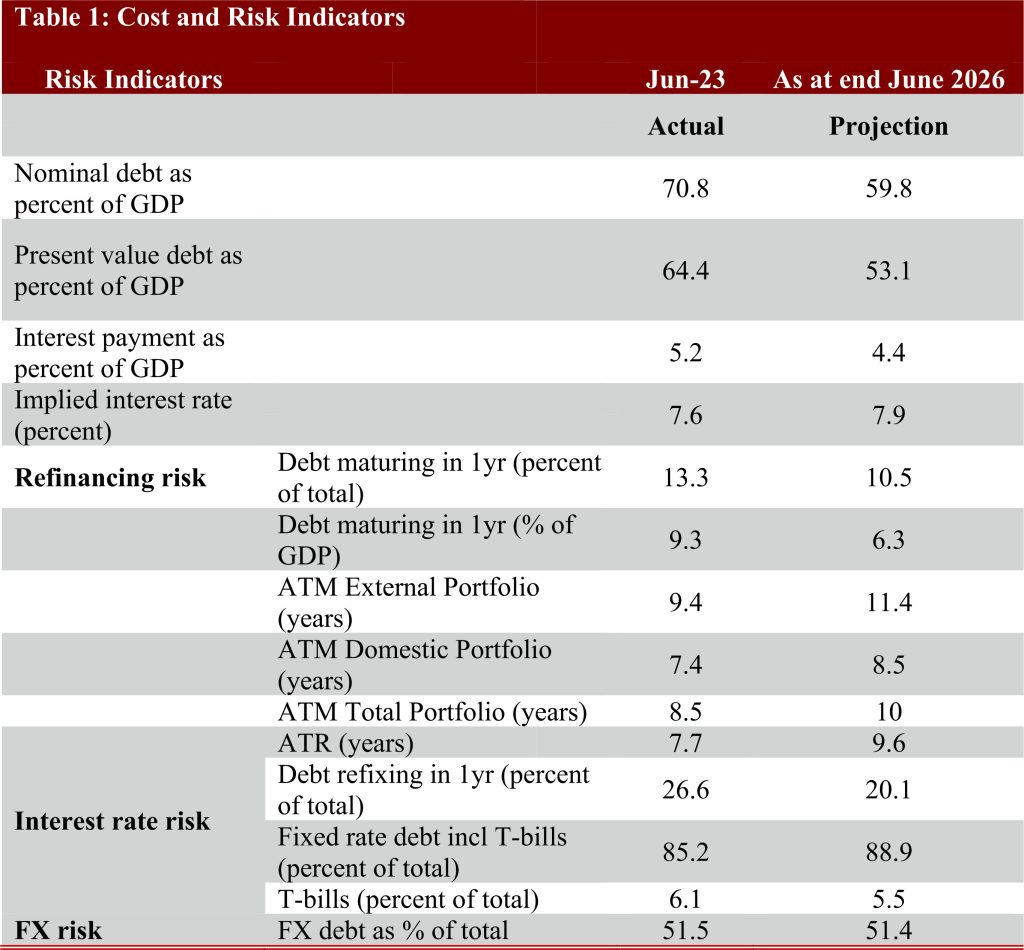

b) Costs and Risks of Kenya’s Public Debt as of End June 2026

i) The National Treasury aims to minimize costs and risks of public debt through optimizing the financing mix between domestic and external sources and instrument targeting.

ii) Under external borrowing, the National Treasury seeks to maximize on the use of concessional borrowing.

iii) From the domestic sources, the objective is to lengthen the maturity profile of public debt and support deepening of domestic market through issuance of medium to long term debt securities.

iv) Reducing costs of debt in form of interest payment as a percent of GDP from 5.2 percent in June 2023 to 4.4 by 2026 through use of fixed interest instruments and maximization of concessional sources and minimization of commercial borrowing.

v) Minimizing refinancing risk by lengthening the Average Time to Maturity (ATM) of the total portfolio, active liability management and issuance of more longer tenor domestic debt instruments. This will be complemented by use of concessional loans with longer maturities.

vi) Minimizing interest rate risk from Average Time to Refixing (ATR) of 7.7 years in June 2023 to 9.6 years in June 2026.

c) The Annual Borrowing Plan for the FY 2023/24

In the FY 2023/24, the National Treasury targets to raise Ksh. 718.88 billion of which net foreign financing amounts to Ksh. 131.47 billion and net domestic financing totals Ksh. 587.41 billion. Borrowing through Government securities amounts to Ksh. 584.22 billion. The USD 2.0 billion Eurobond maturity has been budgeted for in the approved budget of FY 2023/24 and maturity will be honoured in time.

Updated on 28th September 2023